Operator Deep Dive: Dialectic

Introducing Dialectic, Makina's First Operator

Season 1 for Makina is fast approaching. Soon the Machines will migrate, and the first Operator for Makina will be actively running strategies and generating yield for Machine Token holders. The first Operator will be Dialectic, an industry-leading liquid fund that focuses on generating risk-adjusted yield for USD, ETH, and BTC. Makina is the only vault infrastructure on the market that can meet their needs as an Operator, and we’re excited to have them onboard.

Operator Role Overview

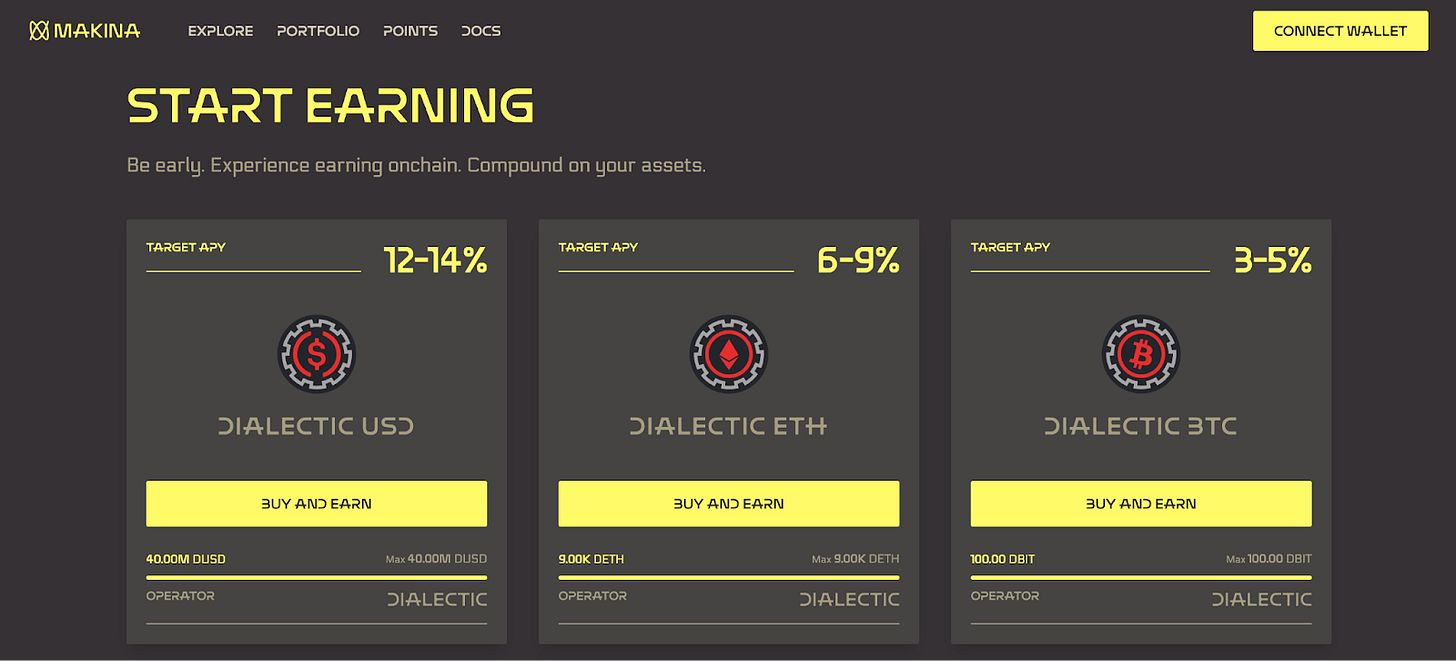

Makina is the DeFi execution engine that allows Operators to run strategies onchain with confidence and opens up new yield-bearing opportunities for users. An Operator on Makina is a professional strategist who executes onchain strategies to generate returns for Machine Token holders. In Makina, users who want to have exposure to a strategy can acquire its associated Machine Tokens (MTs). The first Machines to launch on Makina are yield-bearing strategies in USD, ETH, and BTC from an Operator called Dialectic.

The Operator’s goal is to generate the best possible yield for its Machine Token holders within the risk parameters set in the strategy mandate. When an Operator finds an interesting opportunity to deploy capital to, it must be pre-approved by the Machine’s Risk Manager. This approval could cover the protocols an Operator is allowed to interact with, the amount of leverage, or the assets they’re allowed to use. This keeps the Operator in check and accountable as they run strategies. Being an Operator is an important role: they create significant value for Makina and Machine Token holders. With this in mind, we’re excited to introduce the first Operator on Makina: Dialectic.

Dialectic, First Operator on Makina

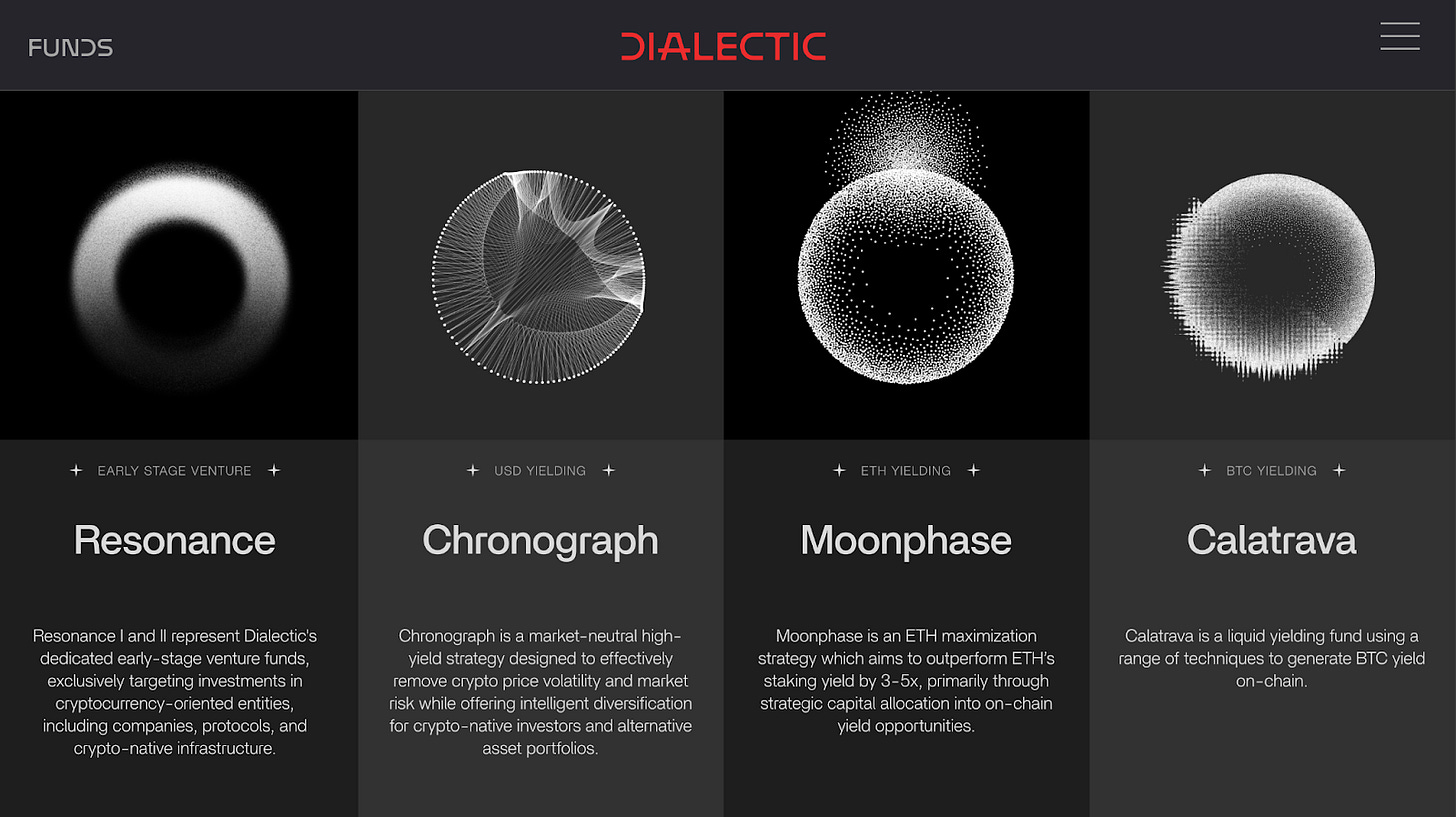

Dialectic is a top-performing asset manager that focuses on producing yield through onchain strategies and generating risk-adjusted returns for its investors. They offer three flagship funds to cover a range of client needs: Chronograph for USD, Moonphase for ETH, and Calatrava for BTC. They have been operational for several years and have weathered the storms of bull markets, bear markets, and the risks that come with depositing into smart contracts. Historically, their fund has only been available to accredited investors and has generated very competitive yields. Now, for the first time, Dialectic will launch strategies that will be available for onchain users to deposit into.

Yields and opportunities are constantly shifting onchain. The best funds need to be able to identify and assess several potential positions at once. Dialectic has developed proprietary infrastructure that allows them to identify yield across multiple chains and protocols. This allows Dialectic to discover thousands of potential opportunities onchain that could generate returns for their funds. They analyze volumes, liquidity flows, and incentive campaigns to generate a predictive model of how returns could potentially play out for a given strategy.

When evaluating a potential deployment, it’s important to understand all of the components that go into the position and what could potentially jeopardize the capital exposed. They need to assess smart contract risk, economic attacks, oracle manipulation, and a range of potential attack vectors before feeling confident deploying into a position. Dialectic developed an infrastructure that is unique to the fund called Medici. With Medici and their Hypernative integration, they can identify economic exploits of protocols and a range of potential onchain hazards that can affect positions before they are live; they can execute real-time withdrawals from protocols via atomic execution in the case of a risk event. Atomic execution is helpful for getting out of looped positions on lending and borrowing markets in a single transaction.

Dialectic uses a layered approach to risk management. Due diligence, strategy diversification, execution automation, and insurance all come together to create an excellent risk-adjusted yielding machine for liquidity participants to invest in and benefit from. If you would like to learn more about Dialectic, check out this interview with Dialectic’s CTO.

Dialectic Strategies on Makina

Dialectic will be running three different Machines for Makina to kick off Season 1: DUSD, DETH, and DBIT. These Machines will engage in a range of yield strategies for USD, ETH, and BTC.

DUSD

DUSD will focus on generating yield for USD through supplying liquidity to bluechip lending markets, asset pairs on AMMs, and buying PT tokens from Pendle or Spectra on quality assets. In some cases they will use leverage looping into strategies when there is enough liquidity to do so. Makina’s infrastructure will allow Dialectic to explore cross-chain strategies and incentives that new ecosystems are offering for battle-tested protocols. To generate risk-adjusted yield for DUSD, Dialectic will be exploring several different assets, chains, and protocol deployments while applying their risk framework to keep users’ funds safe.

DETH

DETH will run strategies on incentivized farming campaigns across EVM networks to generate yield for ETH. This approach will cover a combination of LRT exposure, engagement in lending markets, and provision of liquidity into AMMs while being mindful of impermanent loss and other risks. They will also include PT tokens and leverage looping into the strategy to maximize potential yield.

DBIT

DBIT is the BTC-yielding Machine. They plan to create carry trades across bluechip lending and borrowing protocols. This involves using BTC as collateral to borrow stablecoins and then using these stables to run strategies across different chains and protocols. Similar to DUSD and DETH, Dialectic will generate yield through PT token exposure and looped strategies on blue chip lending markets.

Why Makina for Dialectic

Makina is the most advanced DeFi execution engine that allows funds like Dialectic to execute complex strategies onchain. With Makina, Dialectic can add new protocols to which they’d like to deploy to, in a timely manner. They can bridge assets across different chains and have all positions accounted for onchain. They can still continue to use atomic transactions to be confident in looped positions using Makina. They also don’t need to rely on a shared custody architecture. They can be confident that their strategy will stay within mandate. They can come to Makina with their own setup, whether that’s a Safe or an MPC like Fireblocks, and execute with confidence.

Makina offers the sophistication, professionalism and safety Dialectic needs to deploy their strategies and perform to the best of their abilities.

When Season 1 Kicks Off

Season 1 will start on Monday, October 27th. On this date, Dialectic will activate its onchain strategies on the Machines in Makina. Base-level yields for each Machine will increase, and Makina will be live with its first Operator. Onchain users will, for the first time, be able to get exposure to Dialectic’s yield-bearing strategies and start earning yield from professional strategists. Stay tuned for more content highlighting Operators as Makina grows.

As always, only trust official links:

Website: https://makina.finance/

Substack: https://substack.com/@makinafi

X: https://x.com/makinafi

Discord: https://discord.gg/makinafi

Telegram: https://t.me/makinafinance